How to Calculate Inventory Turnover?

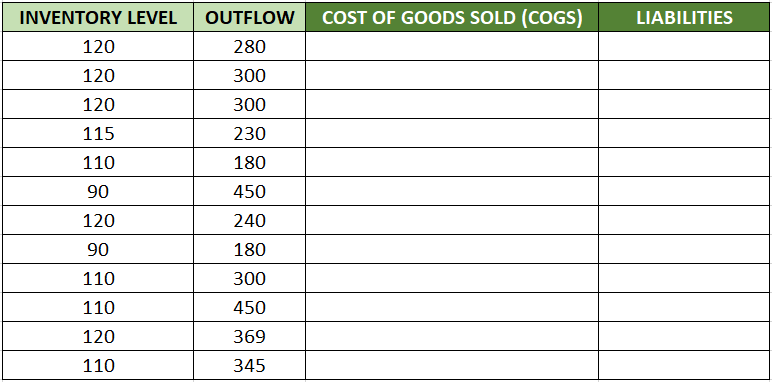

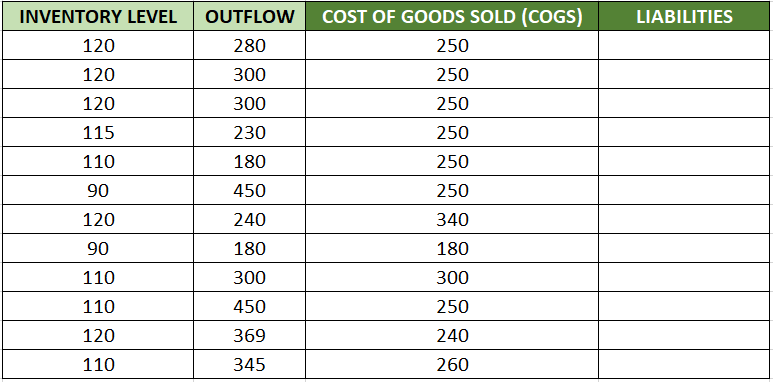

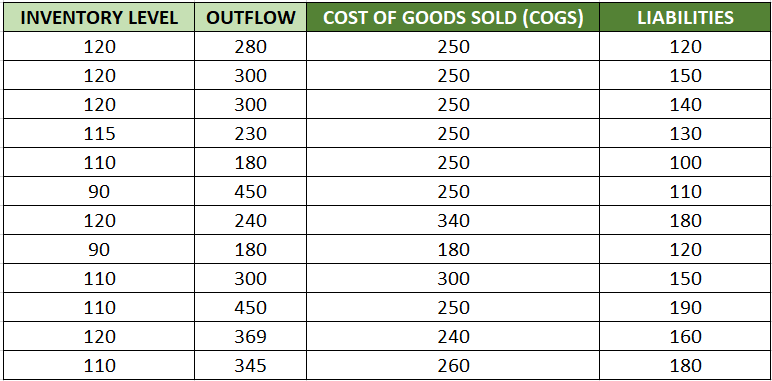

First, determine the period for which you want to calculate the indicator. It could be a quarter or a month. In our sample template, we use months. Enter the data for the average inventory level for the given month in the table, which can be expressed in quantities or values.

You can obtain average data from your ERP system. If you do not use this tool, assume that the average is the inventory level at the beginning and end of the month divided by 2. The more control points you have, the more accurate the average will be. Determine when the inventory level is most representative for the given month.